Why Every Developer Needs a Construction CPA Accounting Firm for Accurate Financial Management

Why Every Developer Needs a Construction CPA Accounting Firm for Accurate Financial Management

Blog Article

Vital Techniques for Efficient Building And Construction Audit in Building And Construction & Realty Projects

In the dynamic landscape of building and construction and real estate, efficient audit techniques are critical to project success. Recognizing the foundational principles of building and construction accounting, coupled with the implementation of work costing approaches, can considerably enhance financial accuracy.

Comprehending Building Audit Basics

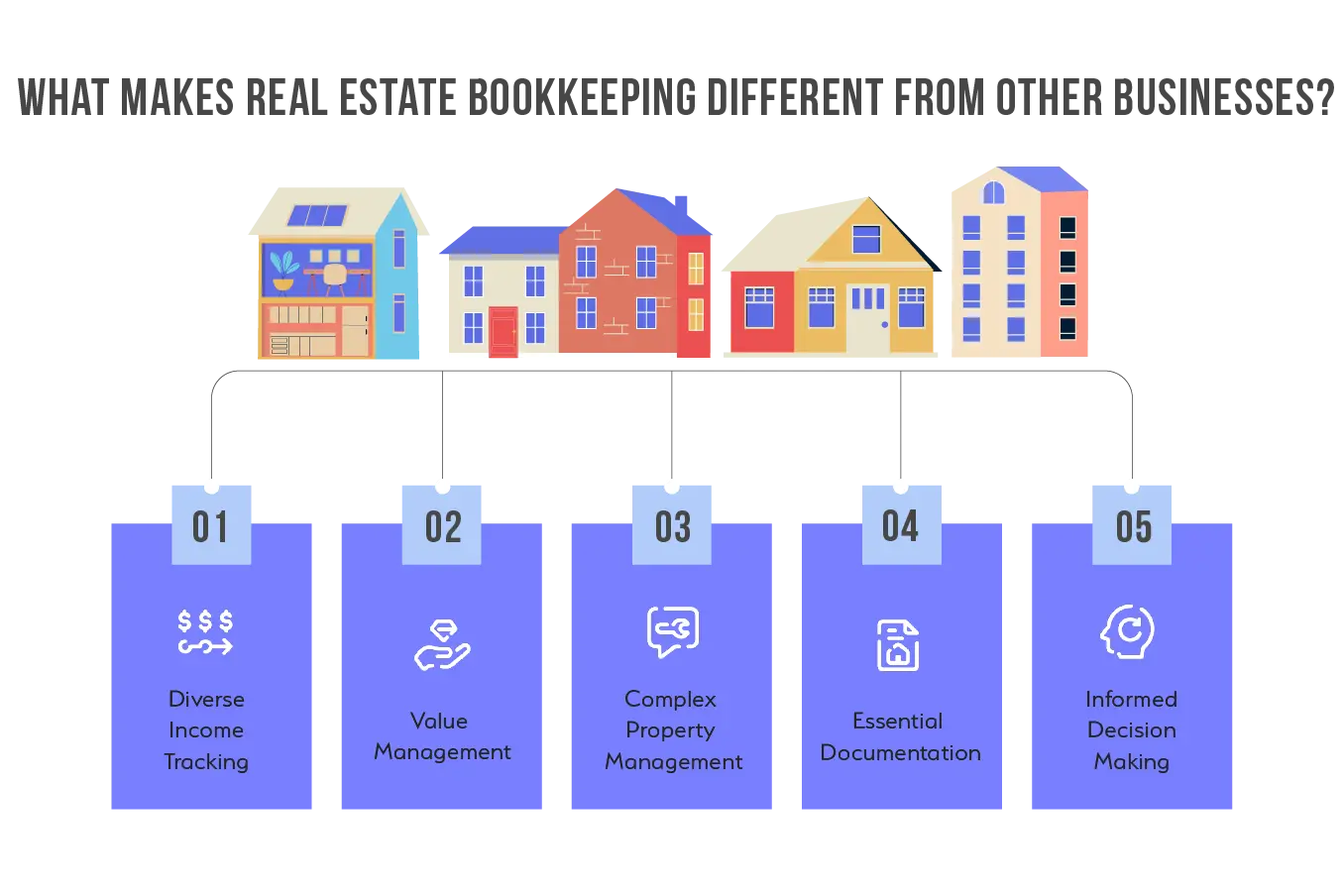

Building accounting is a specialized area that calls for a thorough understanding of economic management principles customized to the unique challenges of the construction sector. Unlike typical accounting, which concentrates on a consistent collection of economic tasks, construction accounting must represent the dynamic nature of projects, rising and fall costs, and differing timelines.

Trick components of building and construction audit include task costing, agreement administration, and monetary reporting. Job costing enables companies to track costs related to particular projects, making sure that budget plans are adhered to and profitability is optimized. Precise agreement administration is vital as it includes the intricate handling of modification orders, progress payment, and retention, all of which can significantly influence capital and task end results.

In addition, monetary coverage in building and construction accountancy requires making use of particular metrics, such as Operate In Progress (WIP) records and percentage-of-completion audit. These devices offer stakeholders with understandings into task performance and economic wellness. By mastering these foundational elements, building specialists can improve economic oversight, improve decision-making, and eventually drive task success, making certain that both long-lasting goals and temporary purposes are fulfilled successfully.

Implementing Job Costing Techniques

Reliable work setting you back methods are essential for building and construction firms to keep economic control and boost profitability. By precisely tracking expenses related to each task, companies can identify areas of overspending, enhance spending plan management, and enhance source appropriation. Implementing an organized method to job costing entails a number of essential methods.

First, develop a clear structure for categorizing expenses. Straight costs, such as materials and labor, need to be divided from indirect prices, like expenses and management costs. This distinction permits more accurate tracking and analysis.

Third, on a regular basis testimonial and update expense data to mirror real-time task conditions. This enables prompt adjustments and educated decision-making, ensuring that jobs continue to be on course economically.

Using Building And Construction Management Software

In today's affordable landscape, leveraging construction administration software program has become an important device for enhancing project effectiveness and accuracy. These software services improve different aspects of building and construction accounting, from budgeting to invoicing, making it possible for task managers to maintain specific monetary oversight. By integrating real-time data monitoring, teams can monitor costs and adjust budgets proactively, making certain that jobs remain monetarily sensible.

In addition, building administration software application helps with enhanced interaction amongst stakeholders. With centralized platforms, all team members, from job managers to subcontractors, can access current financial info, decreasing inconsistencies and enhancing partnership. This openness not just aids in decision-making yet also promotes trust fund among all parties entailed.

Additionally, the automation of routine bookkeeping jobs reduces the possibility of human errors, which can result in pricey financial mismanagement. With attributes such as automated billing and expense tracking, building and construction monitoring software check here enables teams to concentrate on critical preparation and execution as opposed to administrative tasks.

Ultimately, taking on building monitoring software program stands for a financial investment in operational performance, placing companies to react agilely to the vibrant needs of building and construction and property projects. Embracing these devices can substantially elevate the criteria of building and construction audit practices.

Ensuring Compliance With Regulations

Preserving conformity with guidelines is an essential element of successful construction accounting that can not be ignored. Building and construction projects are subject to a myriad of local, state, and federal regulations, affecting whatever from security standards to financial reporting demands (Construction CPA Accounting Firm). It is vital for building accountants to stay educated about these laws to avoid economic problems and lawful fines.

One i loved this secret approach is to apply robust radar that monitor compliance in real-time. This may consist of regular audits of economic records, agreements, and allows to guarantee alignment with regulative expectations. Additionally, investing in continuous training for accounting personnel can foster a culture of conformity, making it possible for the group to swiftly adapt to regulatory modifications.

Establishing clear internal plans that outline conformity treatments ensures that all team members comprehend their obligations. By prioritizing conformity in building and construction accountancy techniques, organizations not just minimize threats but additionally improve their track record and functional efficiency, eventually contributing to the task's general success.

Surveillance Financial Efficiency Frequently

Frequently keeping an eye on financial performance is critical for the success of building and construction tasks, as it offers important understandings right into budgeting, capital, and general job feasibility. Effective economic oversight makes it possible for project managers to recognize discrepancies between predicted and real costs, permitting for timely restorative actions.

Carrying out a structured approach to economic surveillance includes the usage of essential efficiency signs (KPIs) such as profit margins, cost differences, and earned value analysis. These metrics help with a clear understanding of project health, allowing groups to make educated choices.

Constant evaluations of financial information additionally aid in projecting future expenses and revenue, aiding to stay clear of cash money flow lacks that can jeopardize job timelines. Furthermore, employing sophisticated accountancy software can simplify the surveillance process, offering real-time updates and enhancing information precision - Real Estate Tax Services.

Furthermore, establishing a regular for financial performance evaluations cultivates accountability among team participants. Normal economic conferences make certain useful content that all stakeholders remain aligned on job purposes and financial goals. By focusing on constant monetary monitoring, construction firms can minimize threats, maximize resource allotment, and eventually improve project success.

Final Thought

To conclude, efficient building and construction accountancy is essential for the successful management of building and actual estate tasks. By implementing robust task costing techniques, leveraging sophisticated building management software program, making sure regulatory compliance, and consistently keeping an eye on economic efficiency, companies can boost financial oversight and mitigate dangers. These necessary techniques not just advertise adherence to spending plans but also help with informed decision-making, ultimately causing improved project end results and long-term financial sustainability in the building sector.

By grasping these foundational aspects, construction professionals can enhance financial oversight, improve decision-making, and ultimately drive task success, making certain that both lasting goals and short-term purposes are satisfied efficiently.

These software services enhance numerous facets of building bookkeeping, from budgeting to invoicing, enabling job managers to keep exact financial oversight. By focusing on regular monetary tracking, building companies can alleviate risks, enhance source appropriation, and inevitably boost job success.

In conclusion, reliable building accounting is important for the successful administration of construction and real estate jobs. By implementing durable work costing techniques, leveraging innovative building administration software program, ensuring regulative compliance, and consistently checking financial efficiency, companies can boost monetary oversight and alleviate risks.

Report this page